In other words, even if the cost of the family policy is unaffordable, the members of the household are ineligible for a PTC if the cost of the self-only coverage for the employee is affordable and the employer “offered” a family option.

Often called, the “family glitch,” affordability is determined based upon the cost of self-only coverage.

Affordability is determined on a monthly basis. Employees who accept the coverage are not eligible for the PTC, even if the employer coverage is unaffordable. If so, the offer is for affordable coverage, and the employee is not eligible for a PTC, even if coverage is refused. Affordability in 2021 is determined based upon whether an employer plan meeting the “minimum value” standard would cost the employee 9.83% or less of the household income. If “affordable” employer coverage is offered to the taxpayer, the taxpayer is not eligible for a PTC. To be eligible for the PTC for a particular tax year, the premium must be paid by the due date of the return, not including extensions.

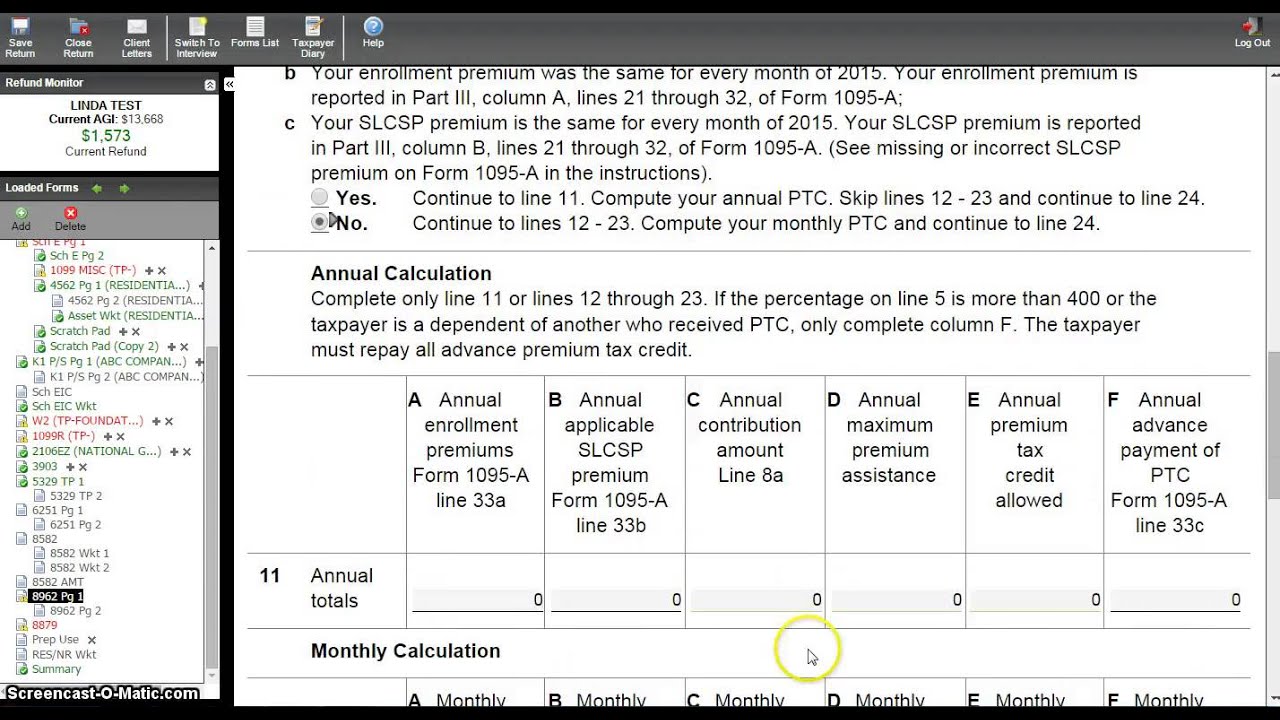

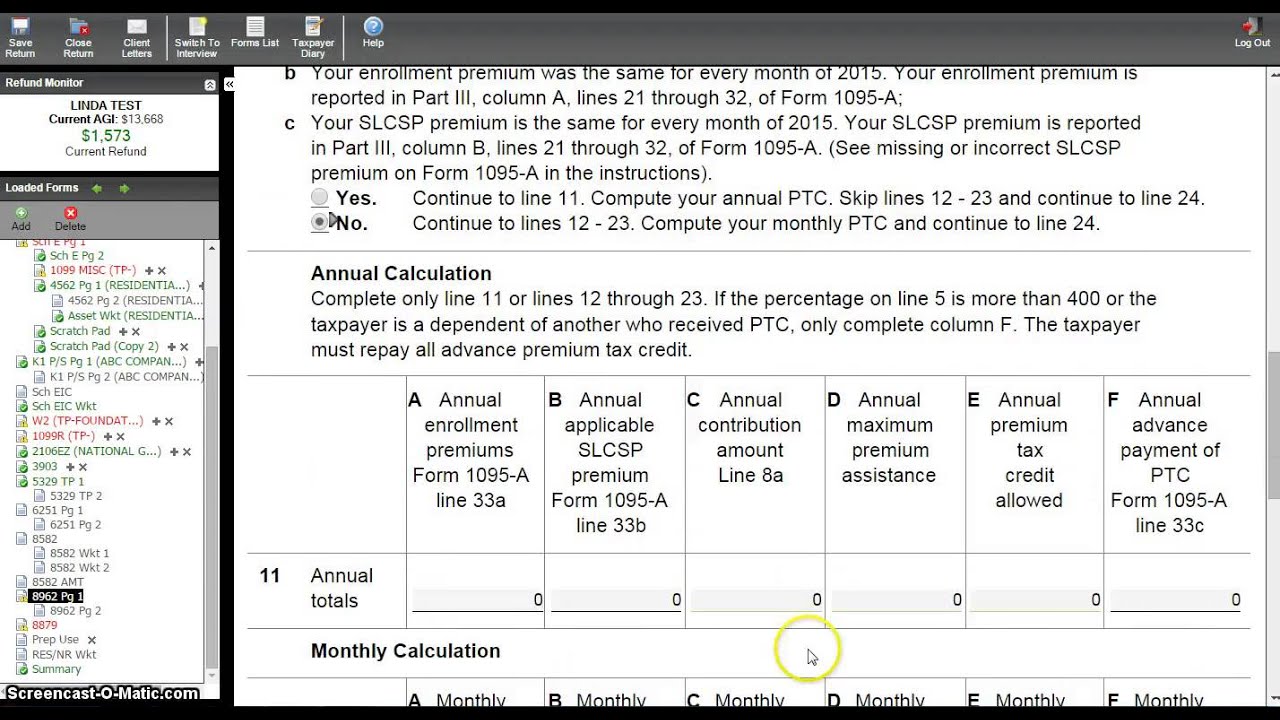

they are not otherwise eligible for affordable “minimum essential coverage” through an employer or other source. a member of their family is enrolled in a qualified plan offered through the Marketplace and. Taxpayers are eligible for a PTC for months during which This means that Sam would pay $2,332 for his Marketplace coverage, and an APTC would fund the balance. Assuming that Sam’s applicable percentage is 8.33% and the premium for the second lowest cost silver plan is $650/month, his yearly PTC would equal $5,468. He is otherwise eligible for the PTC (eligibility rules are discussed below). The PTC, which is often paid in advance through an “advance premium tax credit” (APTC), is generally equal to the premium for the “second lowest cost silver plan” (SLCSP) available through the Marketplace that applies to the members of a coverage family, minus the “applicable percentage” of household income. [ To qualify for Marketplace coverage, the taxpayer may not be eligible for affordable employer-sponsored health plans or other qualifying coverage. The ACA created the refundable PTC for those taxpayers purchasing insurance on the ACA Marketplace with household income between 100 percent and 400 percent of the federal poverty level. Because many farmers and ranchers are self-employed or owners of small partnerships or corporations for which insurance plans may be costly, they may benefit from purchasing insurance on the Marketplace. These changes could mean significant savings to taxpayers purchasing healthcare coverage on the Marketplace. 117-2, significantly enhanced the availability of the Affordable Care Act’s (ACA) premium tax credit (PTC) to make healthcare acquired on the ACA’s Health Insurance Marketplace more affordable for 2020, 2021, and 2022. The American Rescue Plan Act of 2021 (ARPA), Pub L.

0 kommentar(er)

0 kommentar(er)